Child Care Subsidy (CCS)

The Government Child Care Subsidy (CCS) is the main system that assists families with their child care fees. From 7th July 2025, there will be some changes to CCS, meaning child care will be cheaper for most families.

CCS EligibilitySome basic requirements that must be satisfied to be eligible to receive Child Care Subsidy include:

| CCS EntitlementThere are three factors that determine the level of a family's Child Care Subsidy:

|

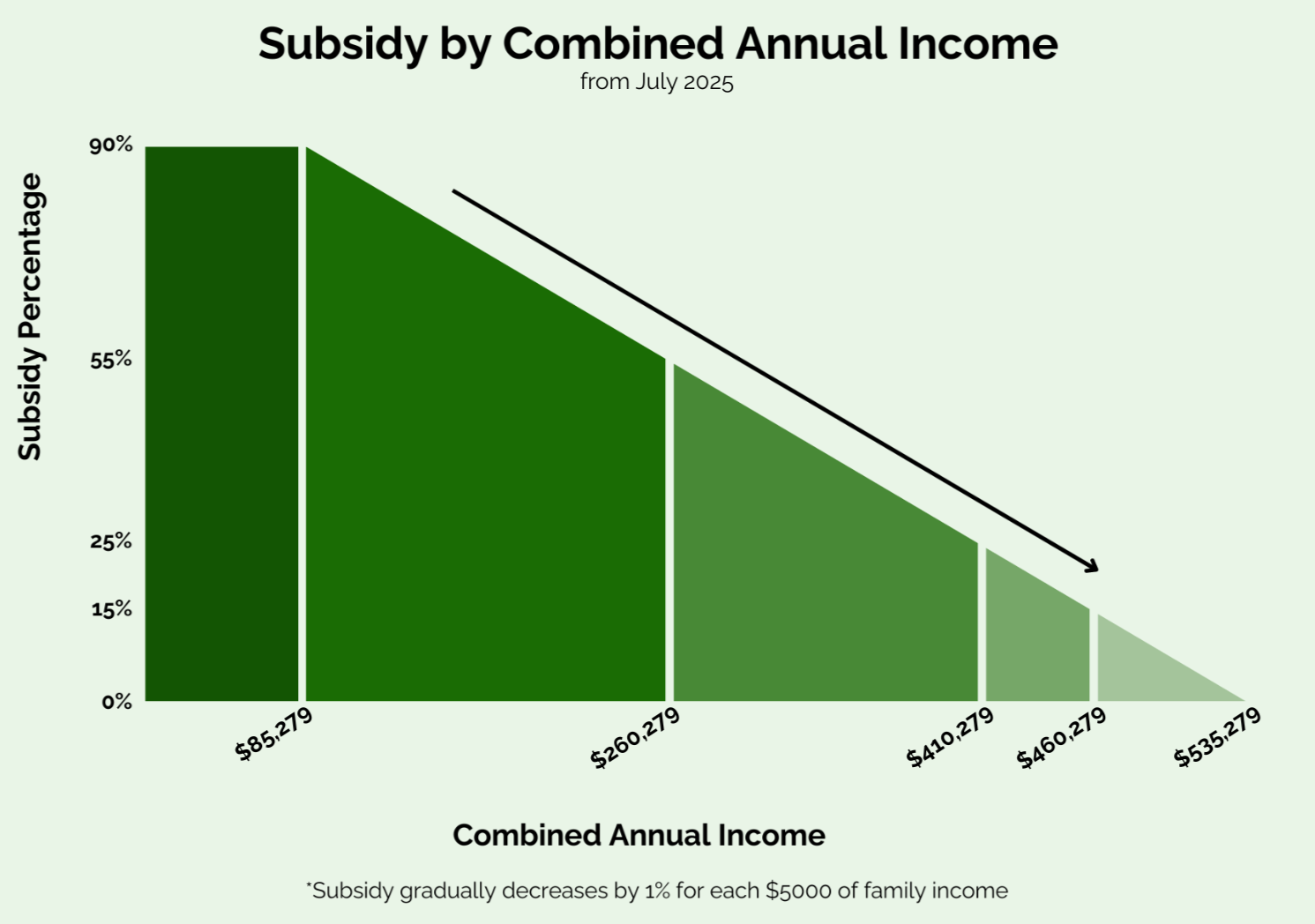

1. Combined Family IncomeThe combined family income determines the family's eligible CCS percentage (Subsidy Rate). Changes from July 2025:

Please refer to Services Australia - Income for more information. Services Australia - Income |  |

| | |

2. Activity Level of ParentThe amount of work-related activity determines the eligible hours of subsidy. The activity level is calculated from the least active parent. Please refer to Service Australia - Activity Level for more information. Service Australia - Activity Level |  |

| | |

3. Type of Child Care ServiceThe Government has different maximum hourly subsidy rates based on the type of child care service. We are classified as 'Centre Based Day Care'. Please refer to Service Australia - Type of Childcare Service for more information. Service Australia - Type of Childcare Service |  |

| | |

4. Number of ChildrenIf you have more than one child aged 5 or younger in care, you may get a higher subsidy. This will apply for one or more of your children. Changes from July 2025:

Please refer to Service Australia - Number of Children for more information. Service Australia - Number of Children |  |

If you have all relevant information, feel free to contact us for an estimate of your out-of-pocket cost, or simply use the online estimate calculator below.

|